#

Payment, Wallet and Tax Management

#

Description

This document outlines the procedures for managing payment methods, wallet settings, and tax management within the Configuration module.

#

Manage Payment Methods

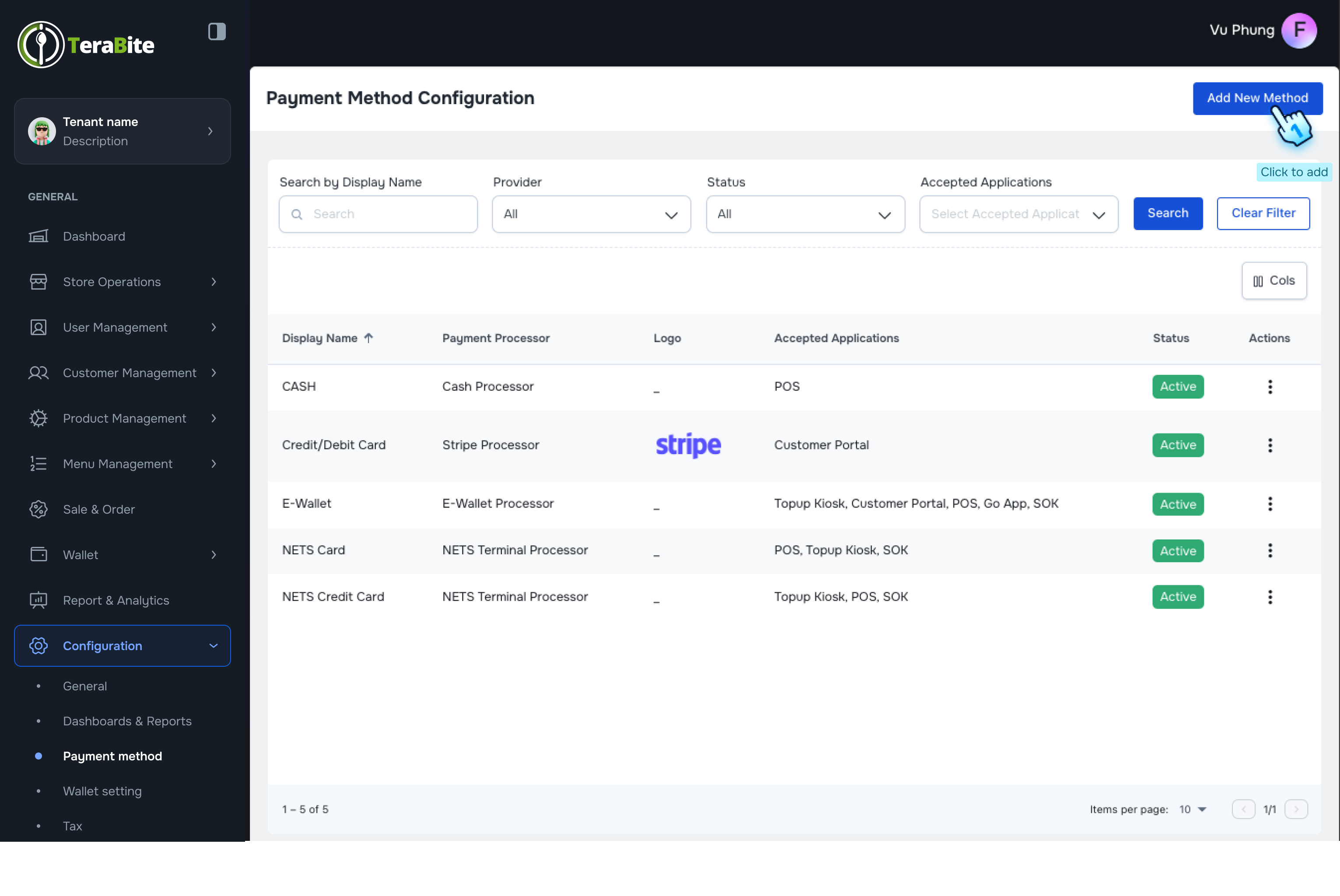

- Access Payment Method Section

- Navigate to the Payment Method section in the Configuration module.

- Initiate Addition of New Payment Method

- Click the "Add New Method" button.

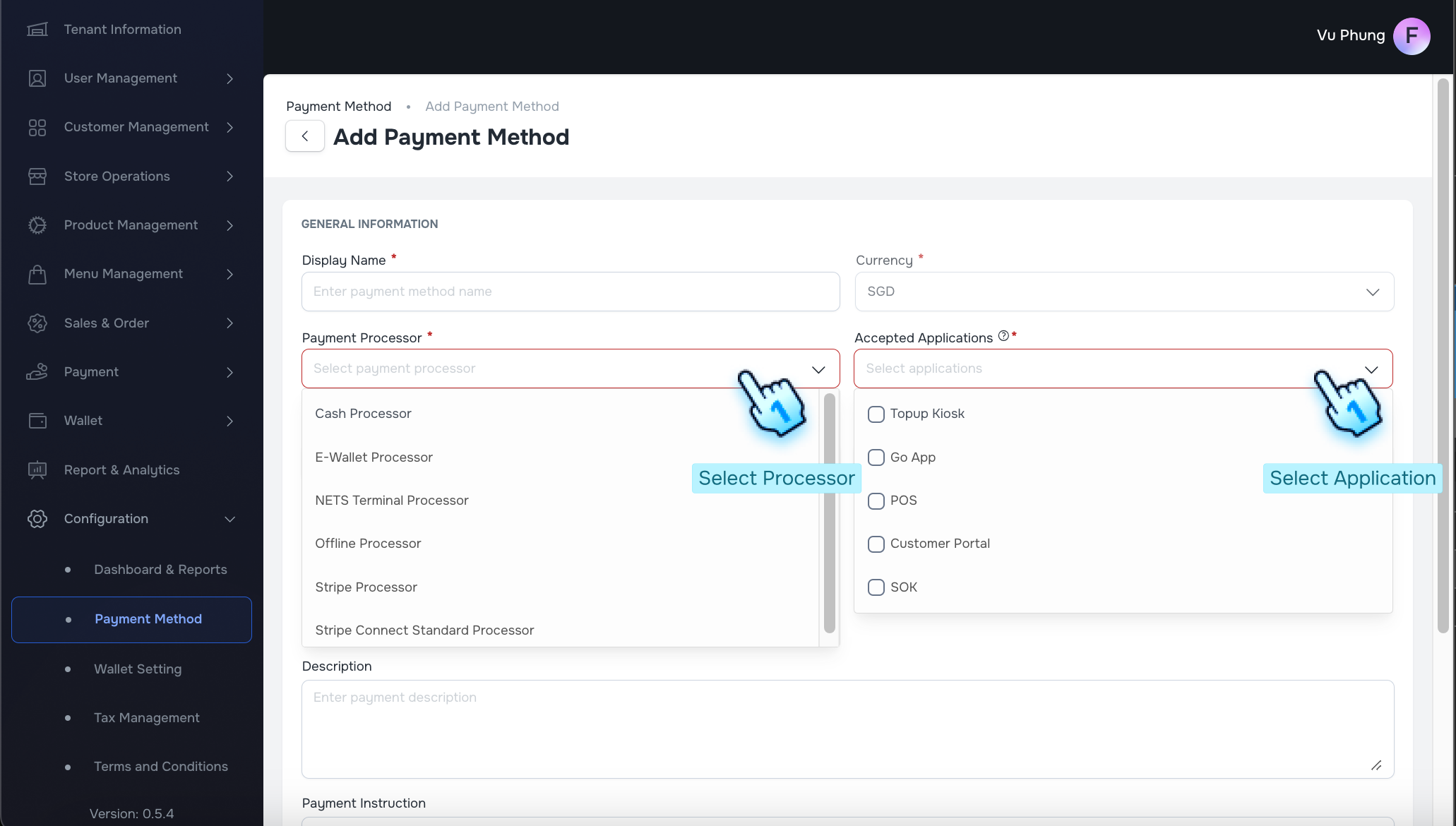

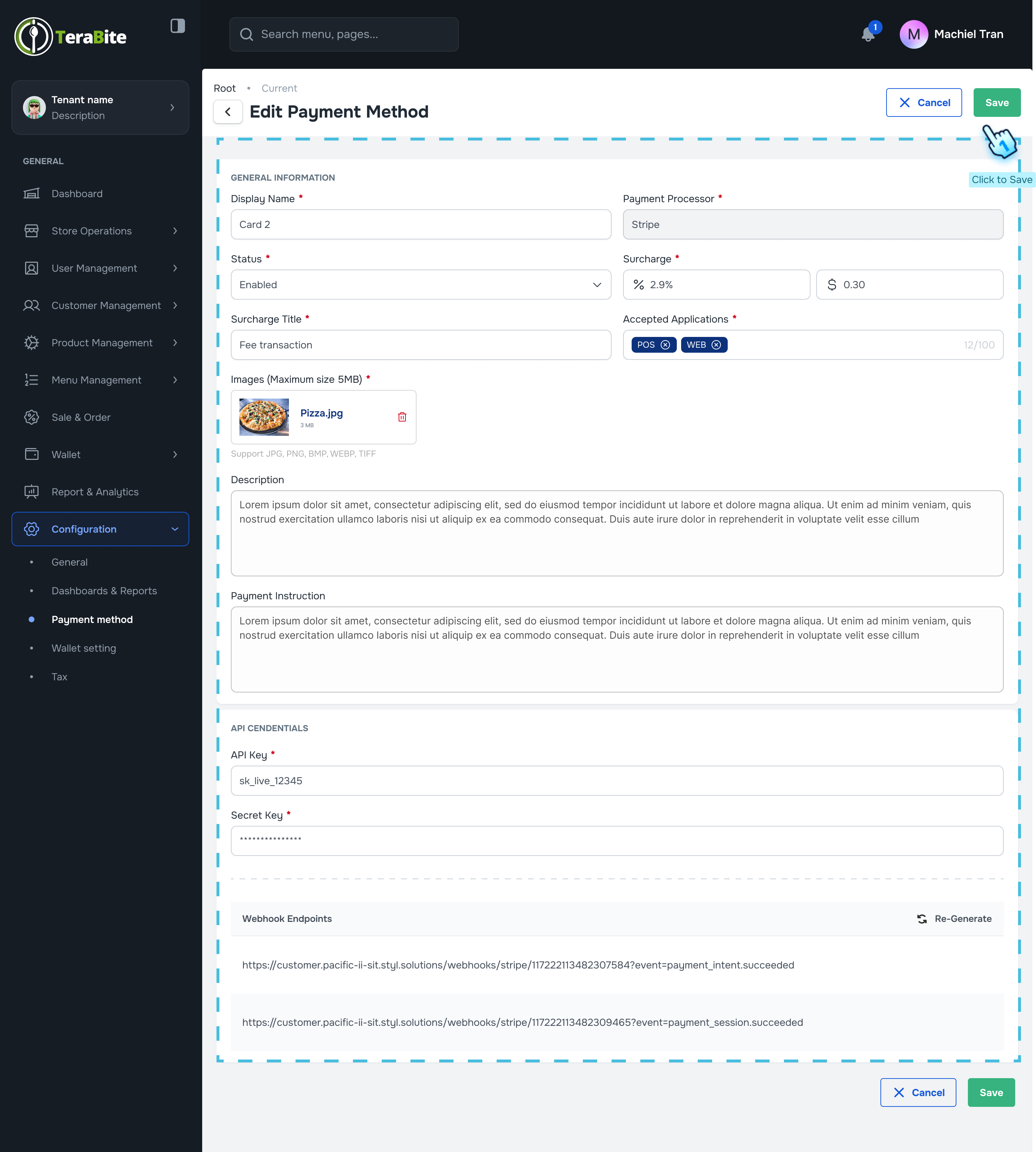

- Fill Required Information

- Complete all mandatory fields with the necessary information for the payment method.

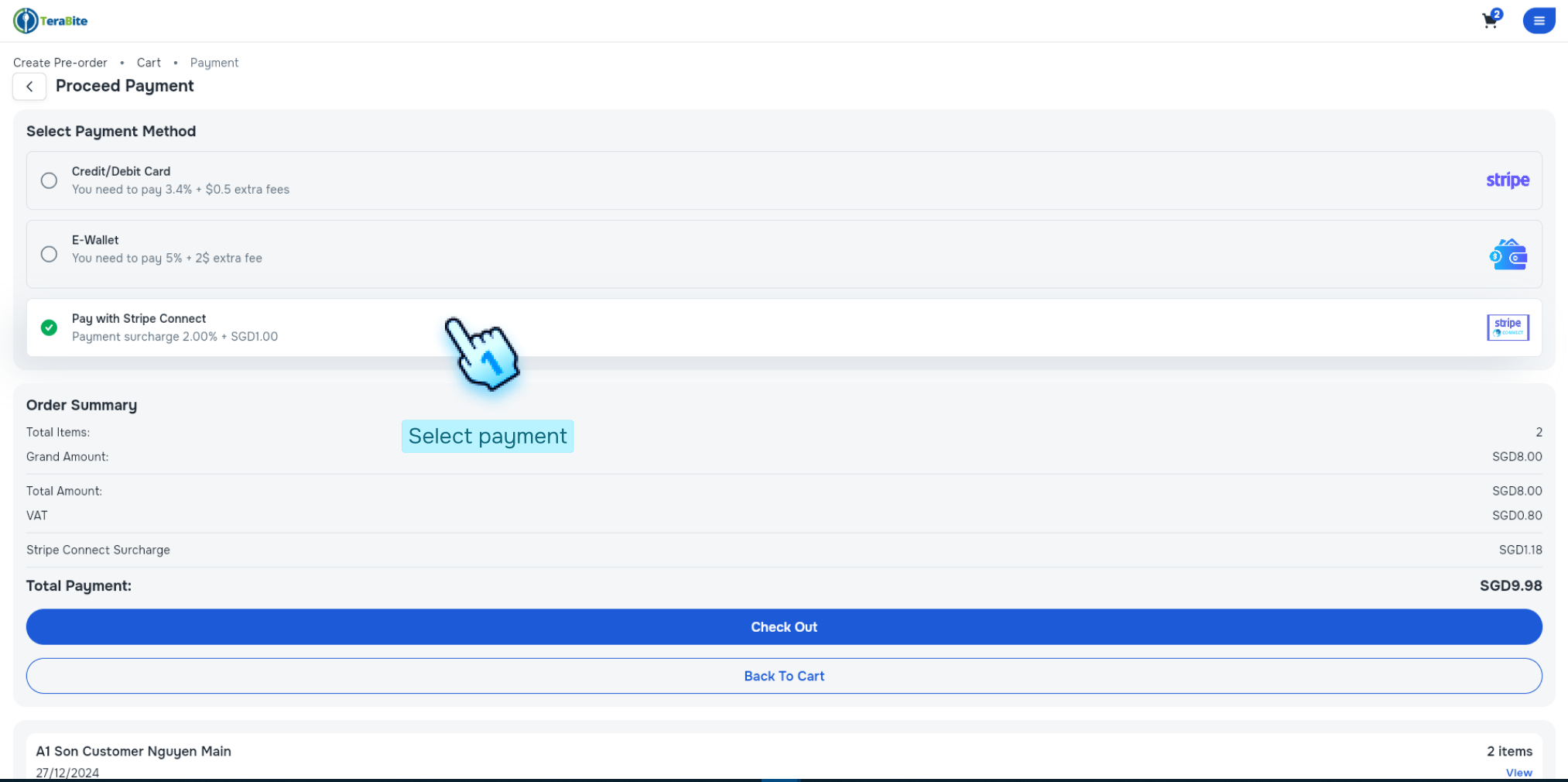

- Select Payment Processor

- Choose the appropriate payment processor. Each processor has specific accepted applications:

- Cash Processor: Top-up Kiosk, POS

- E-wallet Processor: Top-up Kiosk, POS, Go app, Customer Portal, SOK

- NETS Terminal Processor: Top-up Kiosk, POS, SOK. Note: NETS Family Car must be provided

- Stripe Processor: Top-up Kiosk, Customer Portal. Note: API key must be provided

- Stripe Connect Standard Processor: Top-up Kiosk, Customer Portal

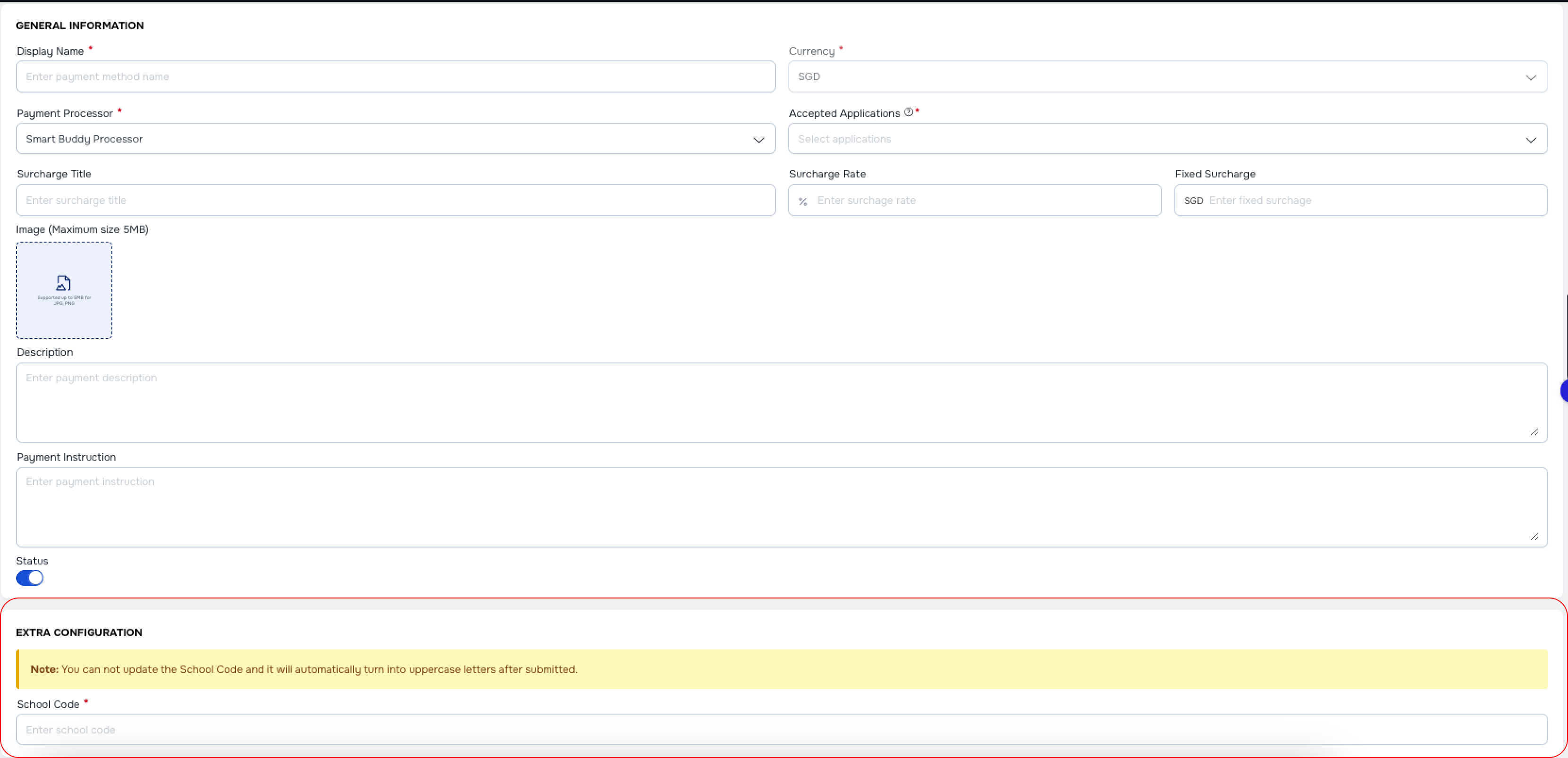

- SB processor: POS Note: When Smart Buddy Processor is selected. The Extra Configuration display for "School Code" Input. This will be entered the correct school code from Caleb system.

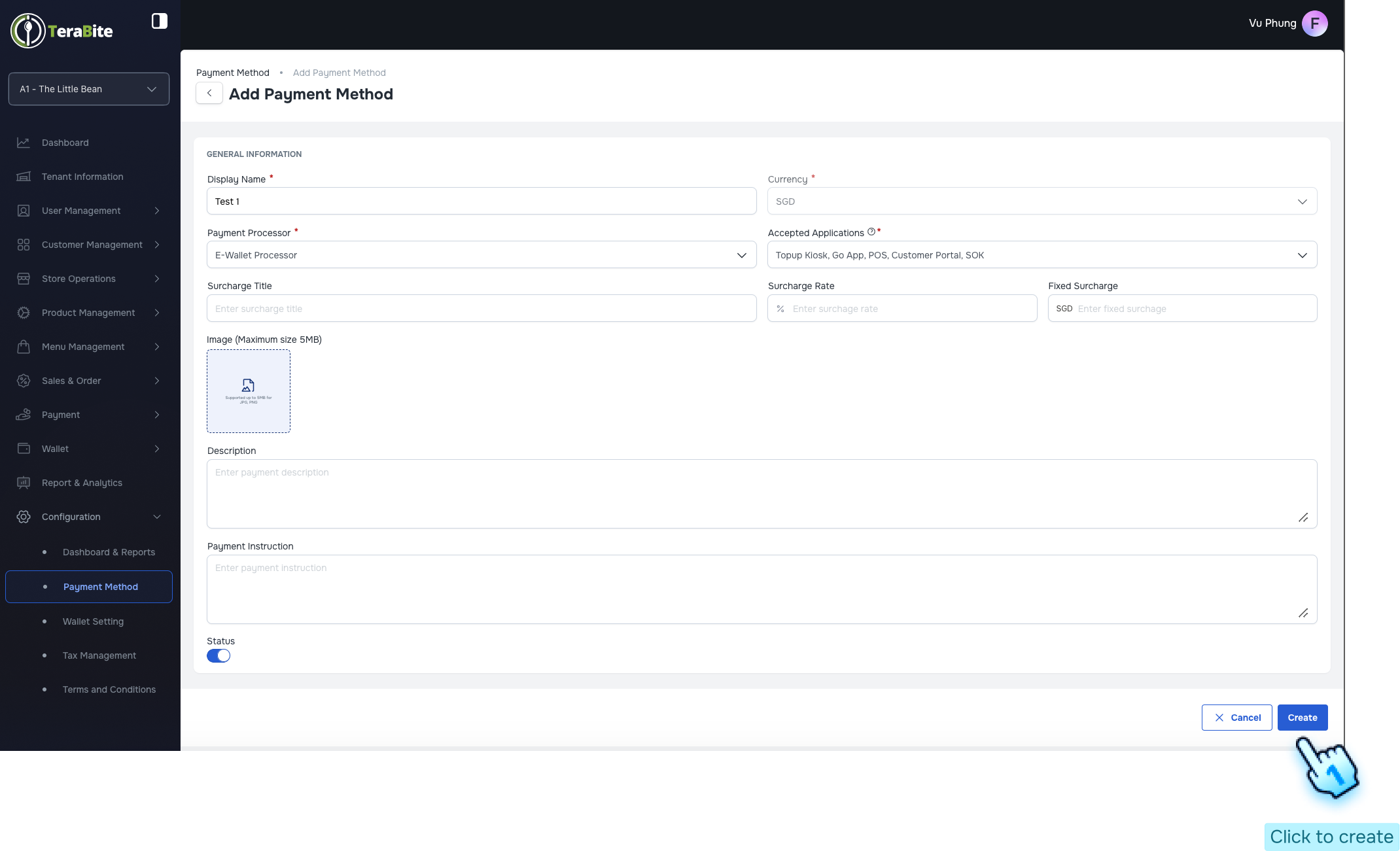

- Toggle the Status On

- Activate the payment method by toggling the status to "On."

- Click Create Button to Finish

- Finalize the setup by clicking the Create button.

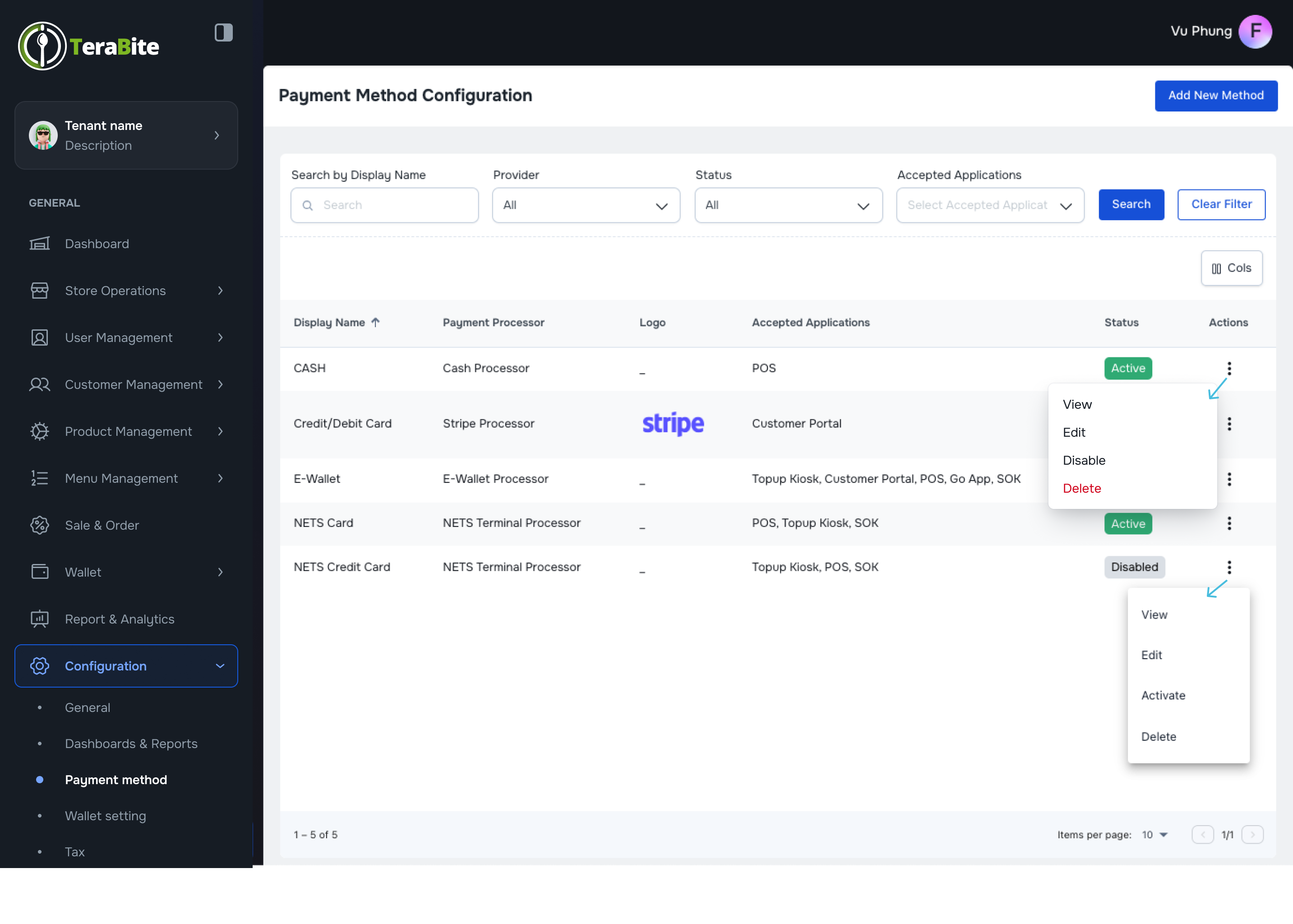

- Actions per Status:

- Active: Options are View, Edit, Disable, and Delete.

- Click the "Disable" button in the three-dot menu and confirm by clicking the "Disable" button in the confirmation dialog.

- Disable: Options are View, Edit, Activate, and Delete.

- Click the "Activate" button in the three-dot menu and confirm by clicking the "Activate" button in the confirmation dialog.

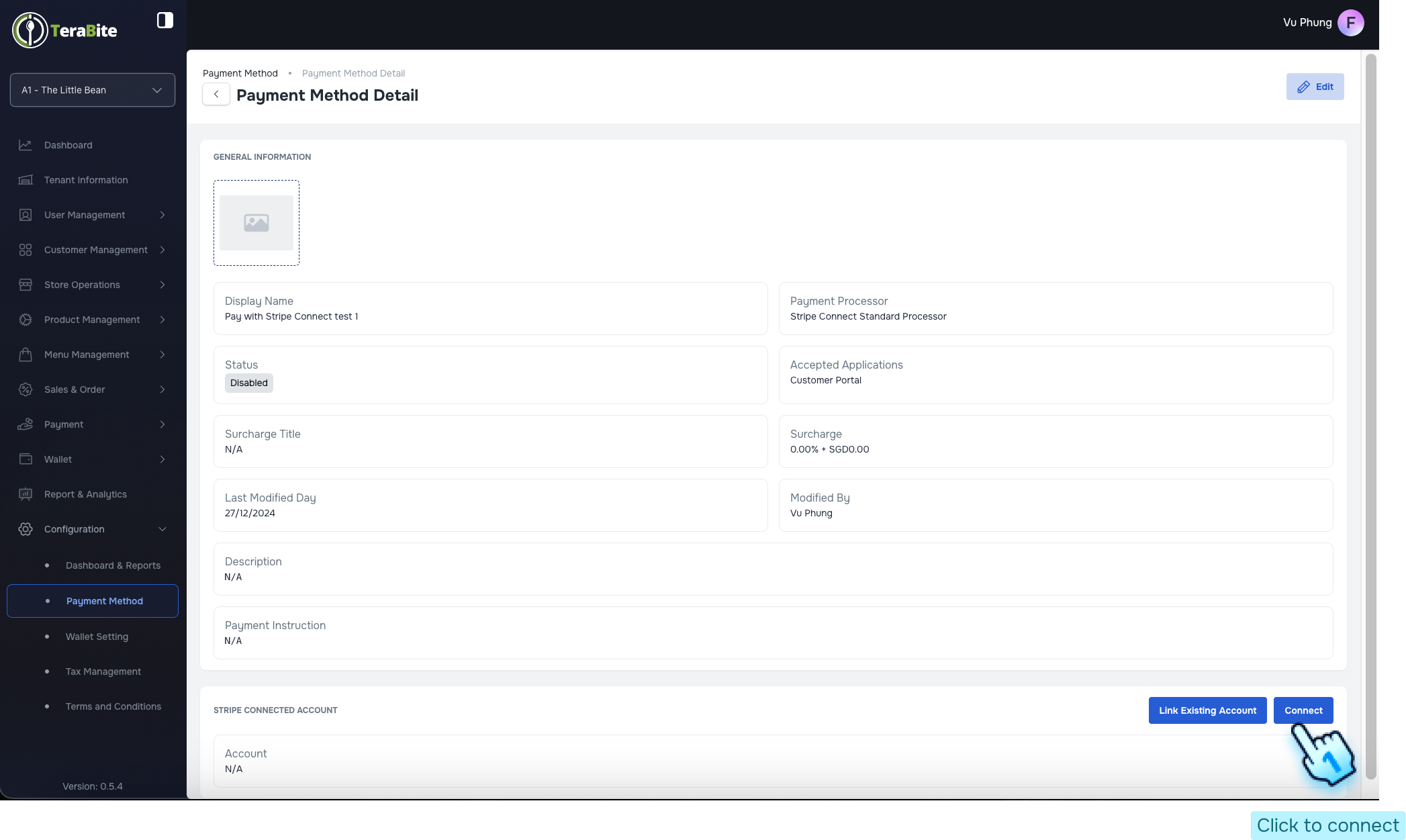

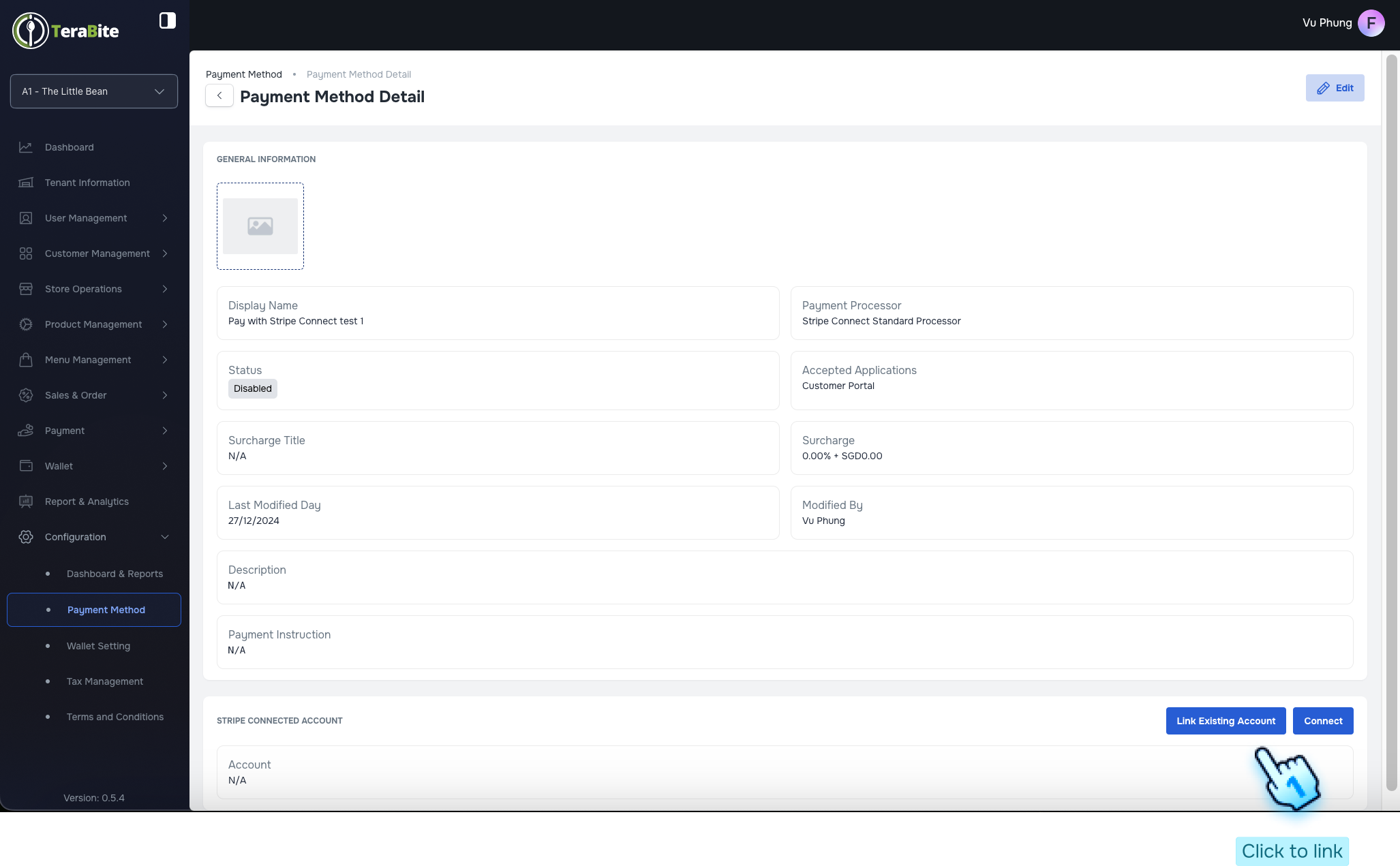

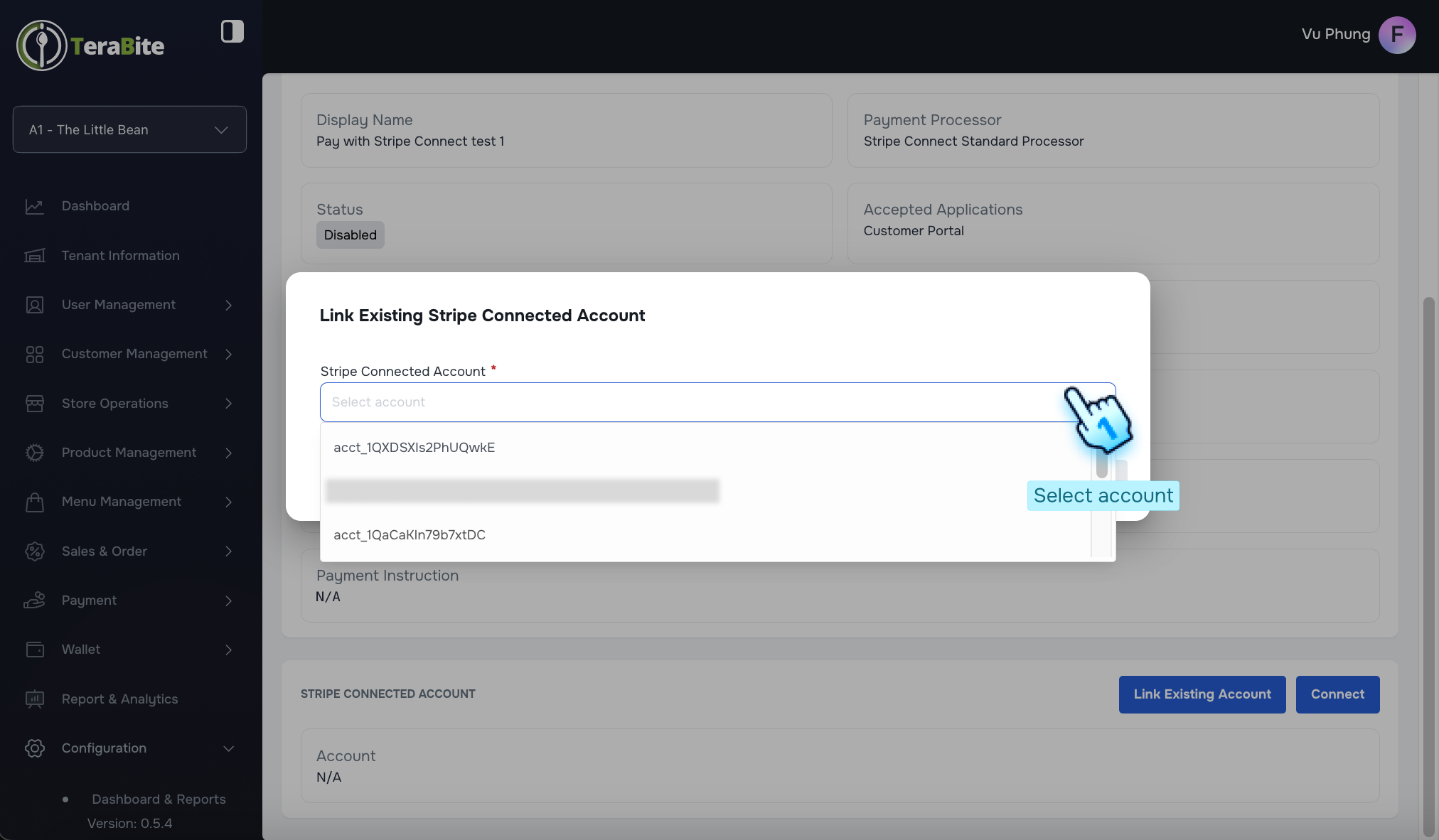

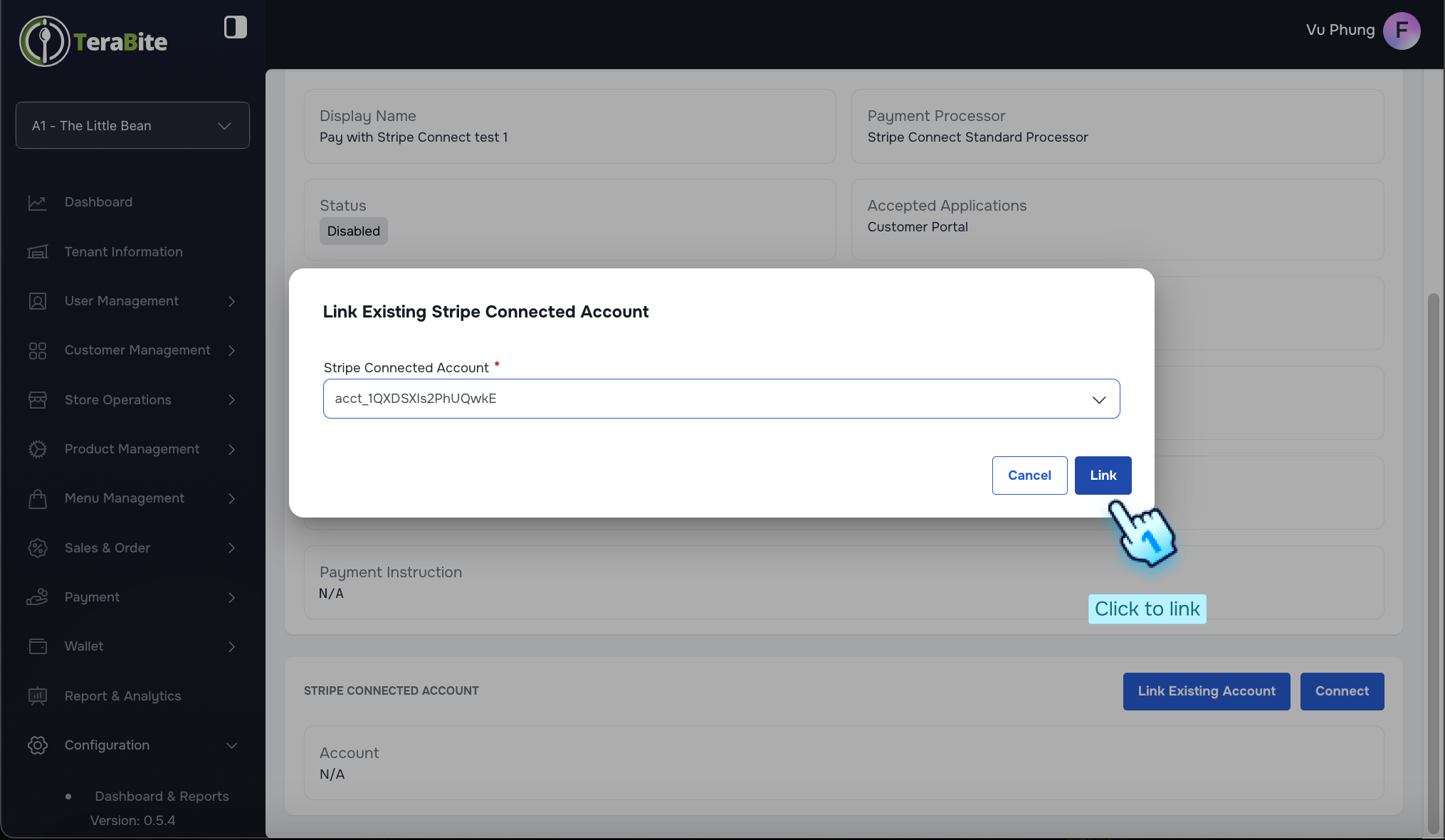

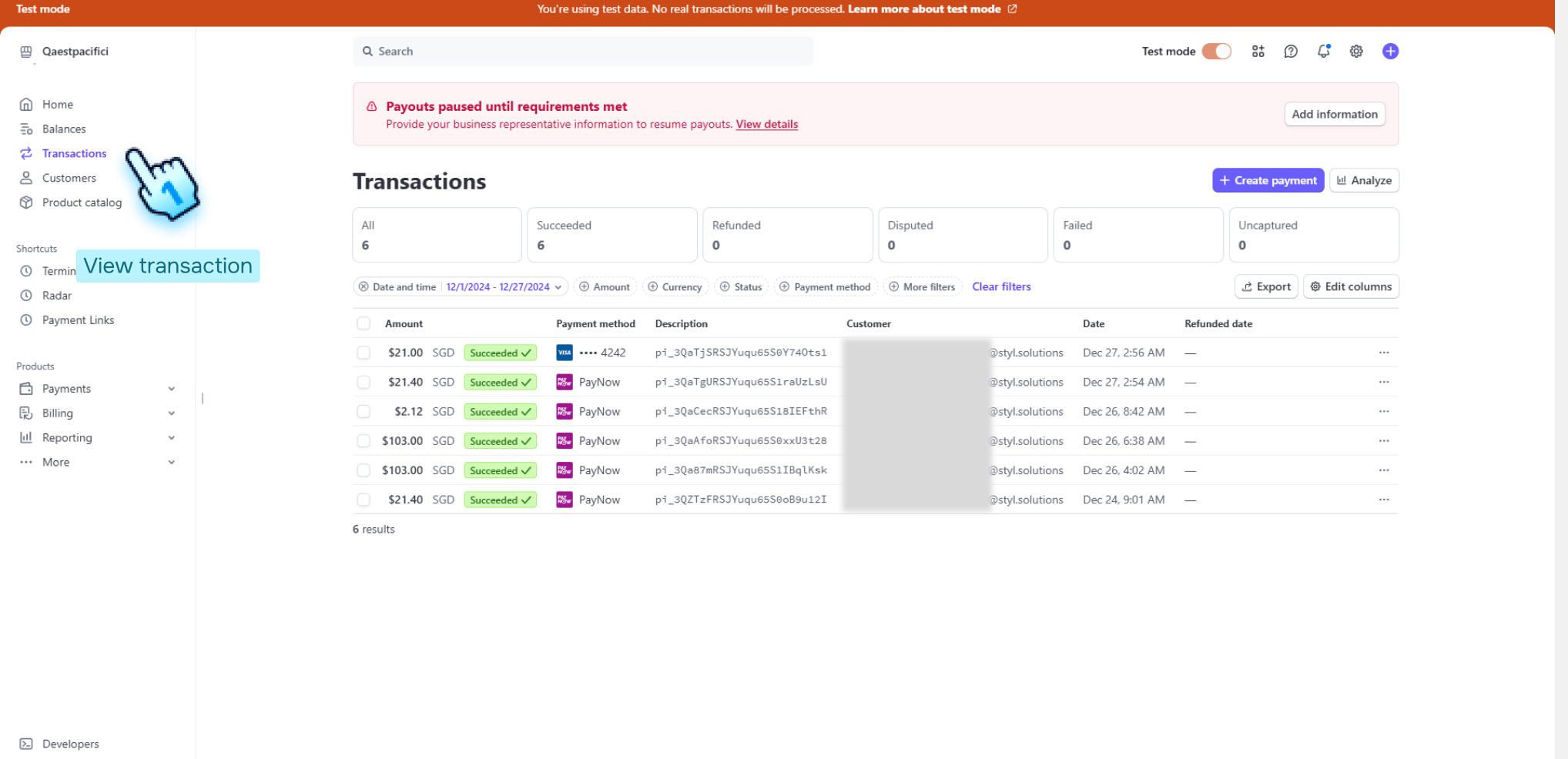

- Accessing Stripe Connect Standard Processor

- For the Stripe Connect Standard Processor, click the View button in the three-dot menu of the created payment method to access transaction details.

- Click Connect Button to Navigate to Stripe

- Click the Connect button to be redirected to the Stripe platform.

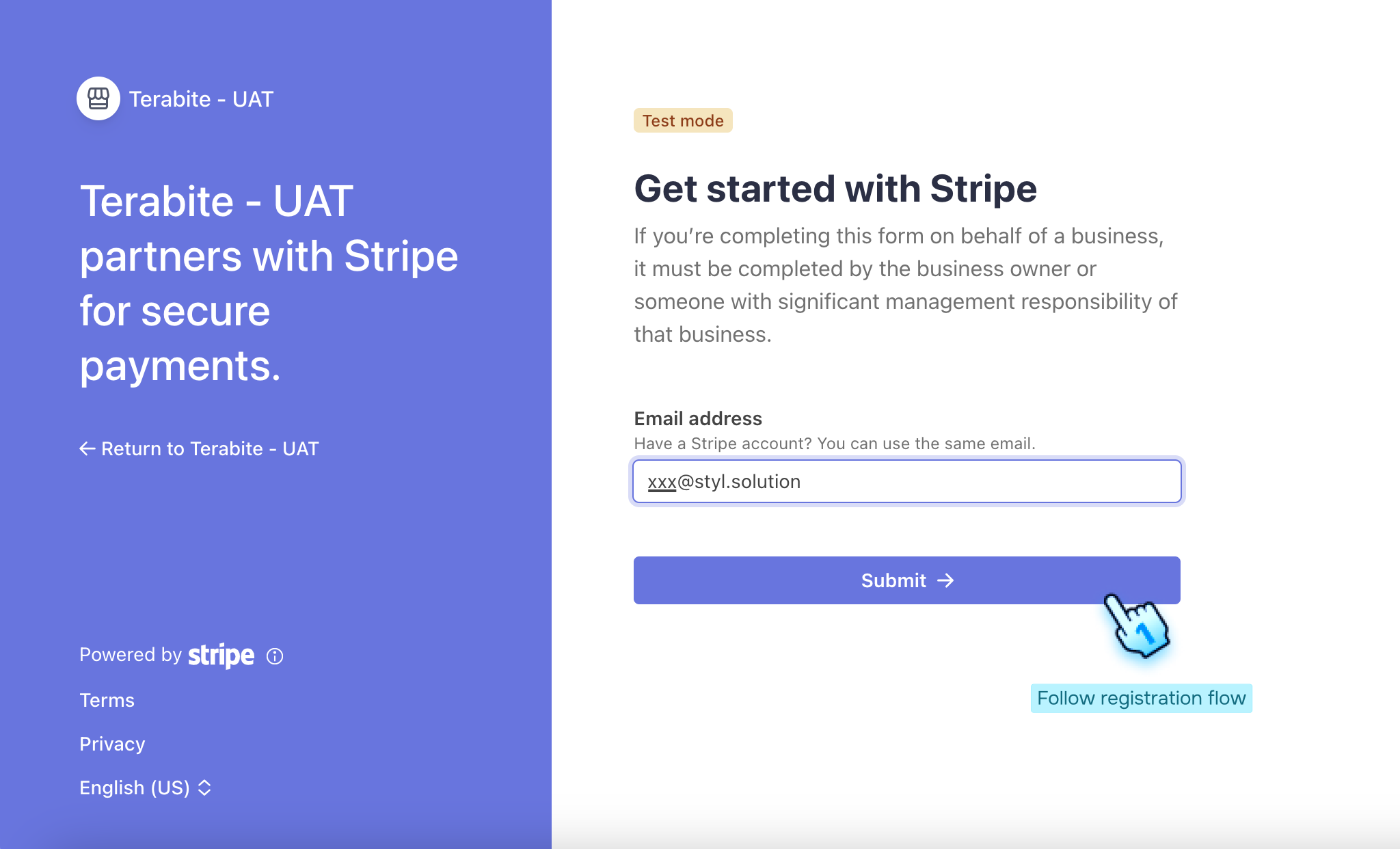

- Enter Email Address to Create Stripe Account

- Provide the required email address to initiate the creation of a new Stripe account.

- Follow Registration Steps of Stripe

- Complete the registration process as prompted by Stripe.

- Login to Stripe

- Access your Stripe account by logging in with your credentials.

- Access Transactions to View History

- Navigate to the Transactions section to review the transaction history.

#

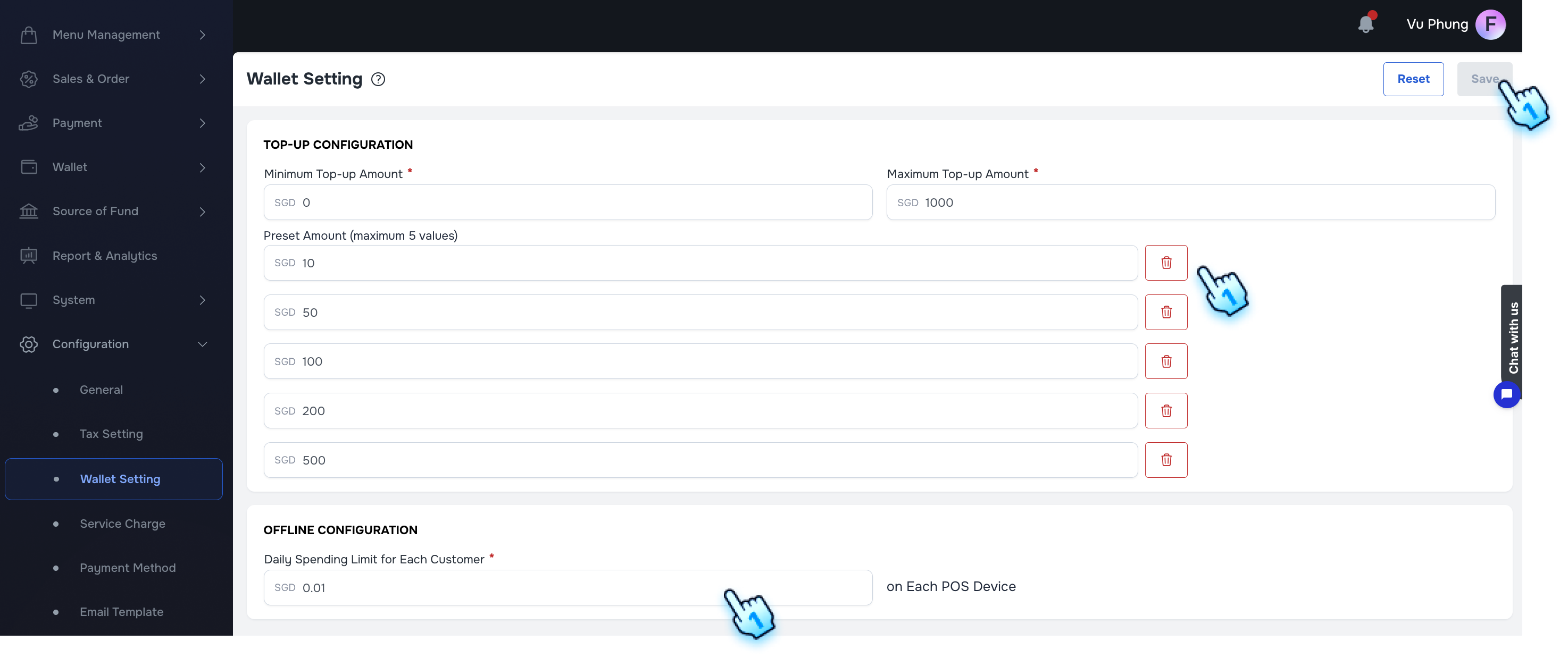

Configure Wallet Settings

- Access Wallet Settings Section

- Navigate to the Wallet Settings section in the Configuration module.

- Adjust Wallet Fields

- Modify related fields, including:

- Minimum Top-up Amount

- Maximum Top-up Amount

- Preset Amount

- Delete Preset Amounts (if necessary)

- Click the Delete button next to each preset amount if applicable.

- Offline Configuration

- Enter the amount of Daily Spending Limit for Each Customer when making payment with Wallet in Offline mode. Note: Exceeding this limit, the payment cannot be processed.

- Save Wallet Settings

- Click the Save button to finalize your changes.

#

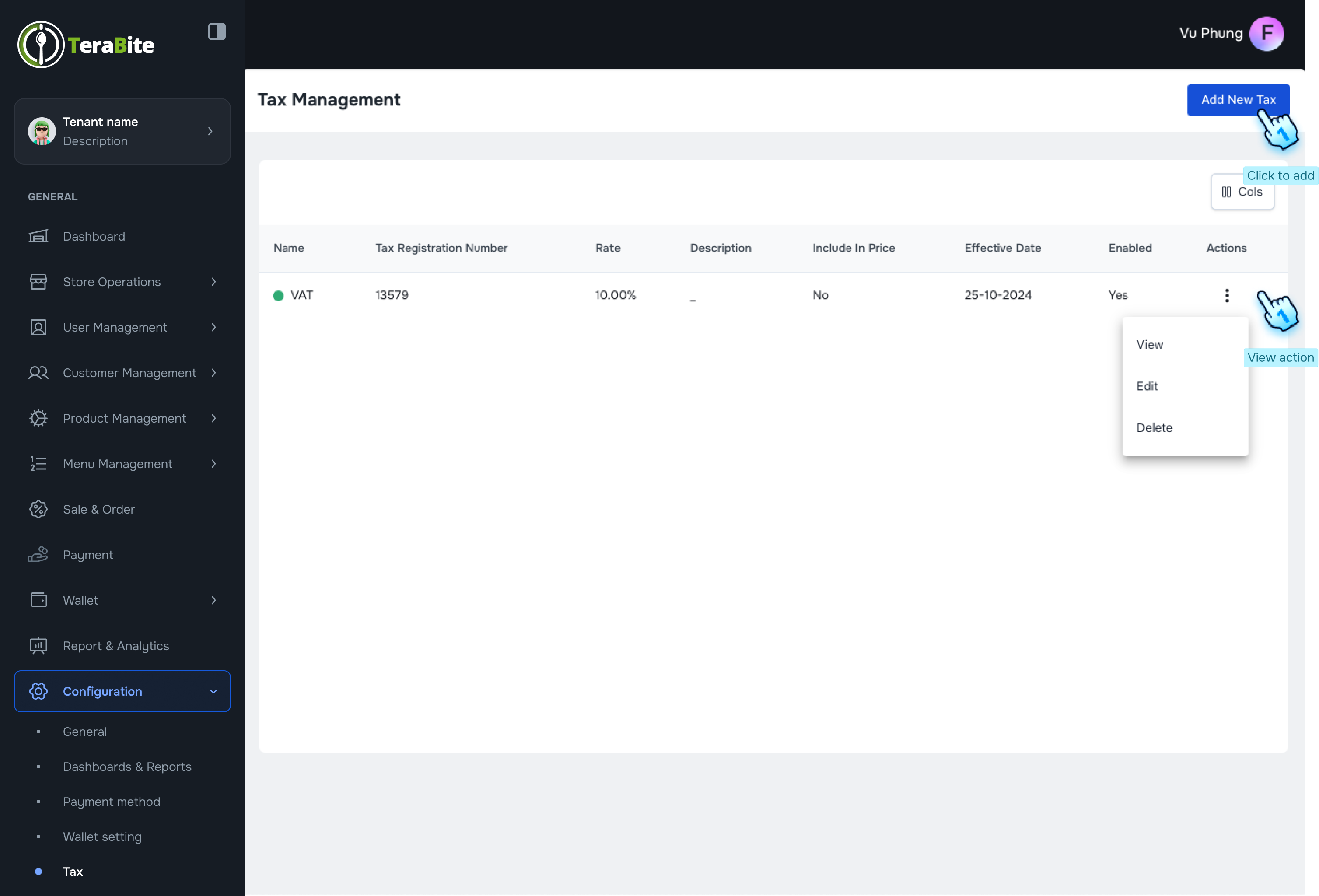

Manage Taxes

- Access Tax Management Section

- Navigate to the Tax Management section in the Configuration module.

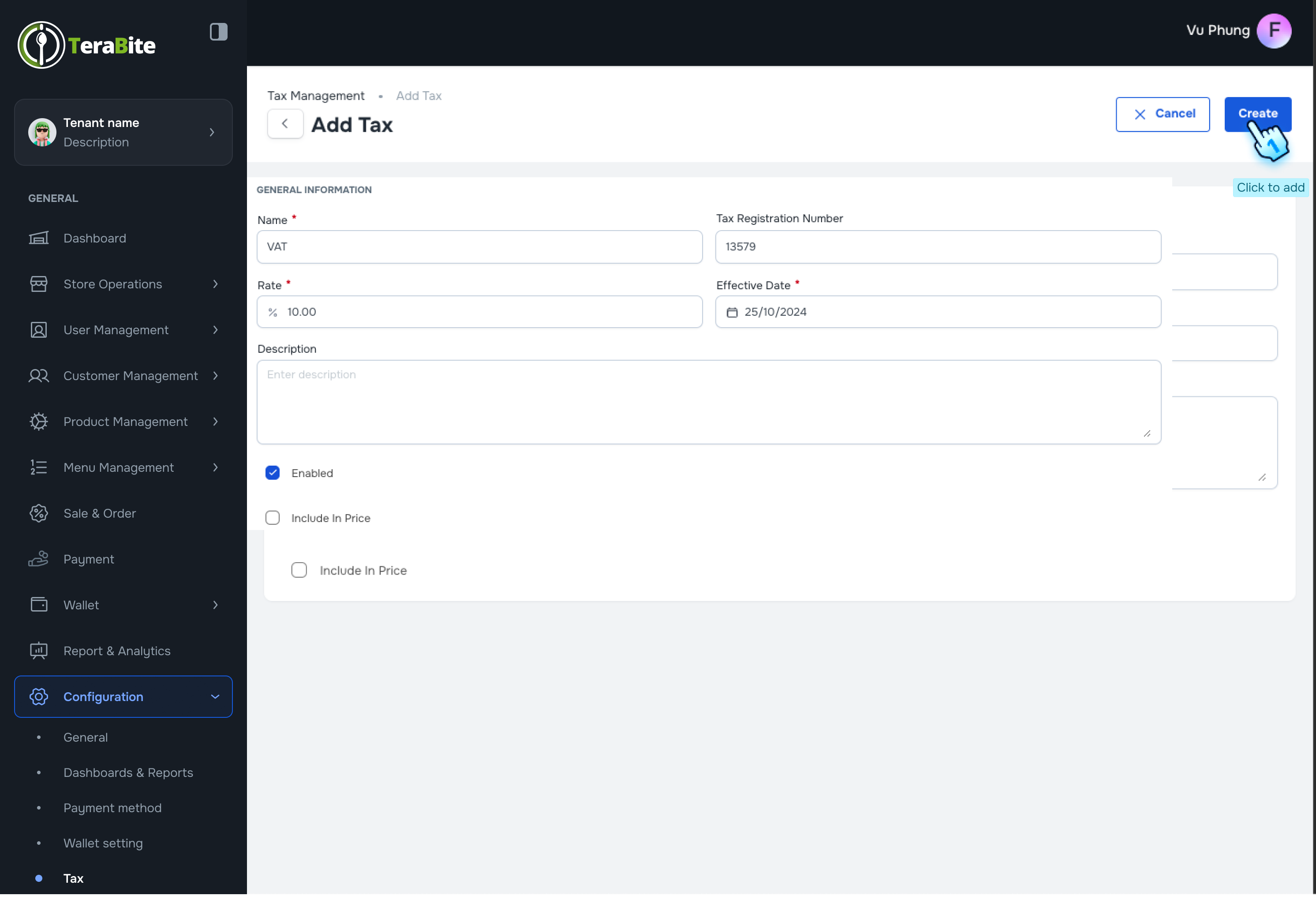

- Initiate Addition of New Tax

- Click the "Add New Tax" button.

- Enter Tax Information

- Fill in the required information and check the checkboxes for the following options:

- Enabled

- Include in Price

- Finalize Tax Creation

- Click the "Create" button to complete the tax addition.

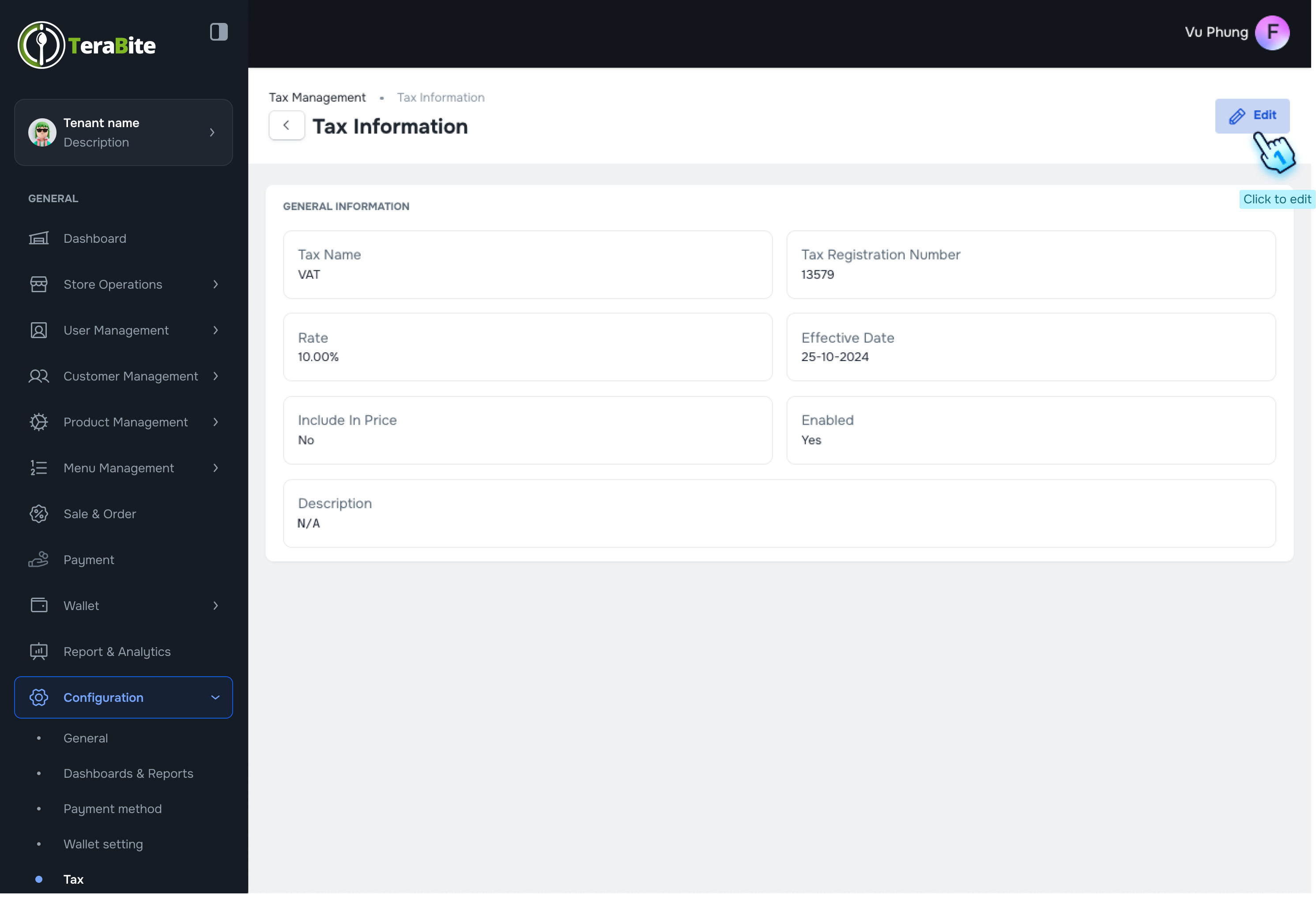

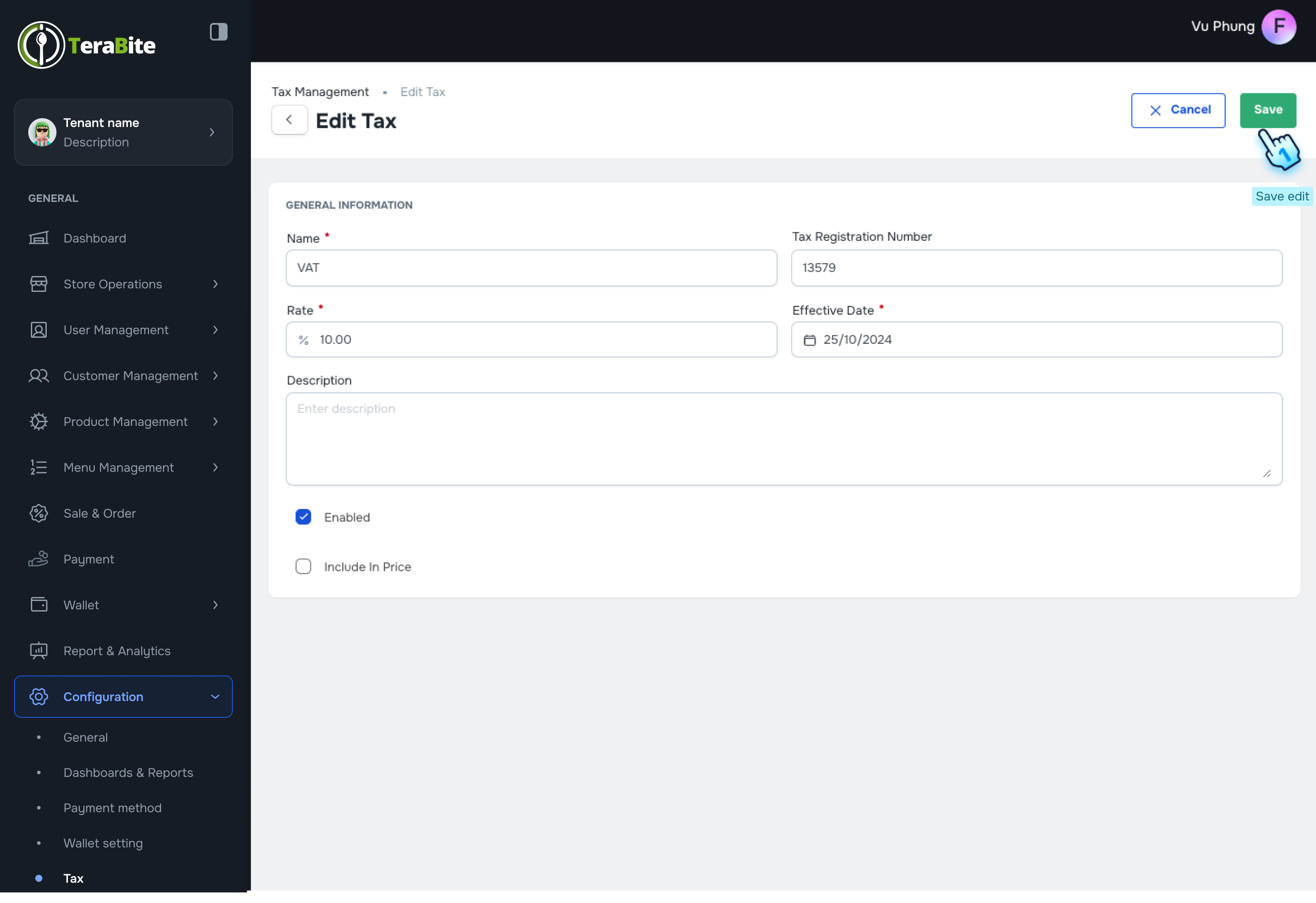

- Manage Existing Taxes

- Click on View, Edit, or Delete in the three-dot menu for each tax as needed.

#

Conclusion

This document provides a structured approach for managing payment methods, wallet settings, and tax configurations within the Configuration module, ensuring efficient financial operations and compliance.

#

Screen flow

#

Payment method

#

Wallet

#

Tax management